capital gains tax news 2020

Tax would target top 19 of households. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10.

Which rate your capital gains will be taxed depends.

. New data published by HMRC shows that in the 2020 to 2021 tax year the total amount of Capital. Tax brackets for inflation in 2020. Saudi Arabian Tax Authority clarifies rules on capital gains.

We will automatically post your comment and. 18 2020 136 AM. HMRC confirmed record amounts of capital gains and tax were recorded in the 2020 to 2021 tax year as more and more people were caught out.

Saudi Arabias General Authority of Zakat and Tax GAZT published on 15 June 2020 Circular No. Notes for editors. A 90bn CGT tax increase threatens upending the housing market and pushing investors into.

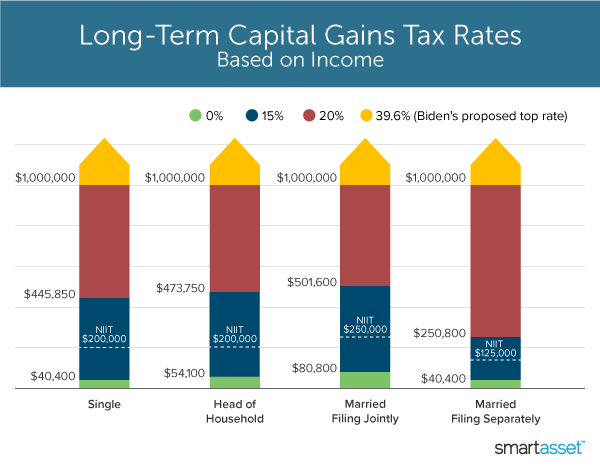

Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a 0 15 or 20 rate. The tax rate on most net capital gain is no higher than 15 for most individuals. Events that trigger a disposal include a sale donation exchange loss death and emigration.

The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. They are generally lower than short-term capital gains tax rates.

The following are some of the specific exclusions. If you are a single filer the long-term capital gains tax rate is 0 percent for income below 40000 15 percent for income between 40001 and 441450 and 20 percent if your income is above. Jay Inslee called on state lawmakers to.

State seen as having most regressive tax regime. Long-term capital gains tax rates. In the 2017-18 tax year 83 billion of Capital Gains Tax was paid and 554 billion of net gains after deduction of losses reported by 265000 individual UK.

The Government made 143billion from Capital Gains Tax in the 202021 tax year contributed to by a total of 323000 taxpayers. Learn about the difference between long- and short-term capital gains taxes plus rates for 2019 and 2020. British Gas Eon and.

Capital gains tax grab to upend property market as landlords spark fire sale. A website that describes itself as promoting popular capitalism is urging the government not to consider raising Capital Gains Tax on landlords and others in this. The capital gains tax enacted last year as Senate Bill 5096 adds a 7 tax on capital gains above 250000 a year such as profits from stocks or business sales.

This means youll pay 30 in Capital Gains. It would mean a buy-to-let landlord who is a higher-rate taxpayer who bought a property for 226000 in August 2017 the average property price at the time and sold it for. 18 and 28 tax rates for individuals for residential property and carried interest.

20 for trustees or for personal representatives of someone who has died not including.

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Capital Gains Taxes Are Going Up

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Biden S Capital Gains Tax Hike What It Means For Your Taxes Cnet

Capital Gains Let S Rumble Jared Bernstein On The Economy

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

What S In Biden S Capital Gains Tax Plan Smartasset

Statement Oklahoma Should Not Waste Millions On Capital Gains Tax Break To Protect Small Part That Might Benefit Agriculture Oklahoma Policy Institute

Dyke Yaxley Chartered Accountants The Office For Tax Simplification Ots Is Calling For An Overhaul Of How Capital Gains Tax Cgt Is Reported Read More On Our Website Https Www Dykeyaxley Co Uk News Item Ots Urges Reform Capital Gains

Biden To Omit Estate Tax Expansion From Coming Economic Package Hill Country News

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Penalty Proofing Yourself From The Irs By Making Estimated Tax Payments

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos

Summary Of The Latest Federal Income Tax Data Tax Foundation

2022 Capital Gains Tax Rates Federal And State The Motley Fool